SBA Targeted EIDL Advance

Many of you are receiving emails from SBA like this one that are promoting targeted advance payments that do not need to be repaid. If...

Dental Office and Personal Tax Planning for 2021 and Beyond

In a normal tax year, our tax planning strategy would be to minimize taxes now and worry about next year’s taxes, well, next year. 2021...

IRS Service Issues Continue

Many of us taxpayers and tax practitioners began experiencing service issues with the IRS right about the time the pandemic hit in early...

Paying for Building Back Better

I sat in on a webinar yesterday where Karen Miller, tax professor at The University of Alabama, provided insight on the latest on...

HRSA Announces Phase 4 of Provider Relief Funds

HRSA will begin accepting applications for its latest round of Provider Relief Fund grants on September 30, 2021. Though it is unclear...

What The Trump Organization legal woes can teach us about payments to employees

Last month, the New York City District Attorney’s office announced that it had indicted Allen Weisselberg, The Trump Organization’s CFO...

Biden’s plan to eliminate the inheritance basis step-up is a big deal!

I am not sure you could call this “under the radar” because it has gotten plenty of attention, but Biden’s plan to eliminate the basis...

Curious About the New Biden Tax Plan? I’ve Got You Covered.

A couple nights ago, President Biden addressed the nation and unveiled his American Families Plan. The key tax benefits are an increase...

Are Automobiles Deductible? Maybe!

As a tax advisor, I field countless questions regarding what is a deductible business expense and what is not. While some expenses are...

Capture the Tax Benefits from Your Real Estate Quickly

Non-residential real property is deductible over 39-years, so by the time most doctors are in the financial position to consider...

Build Practice Value: Have Your Cake and Eat It Too!

You can't have your cake and eat it too. You've heard that expression, right? Said another way, you have choices in life, and oftentimes,...

The Tax Distinction Between Wealth and Earnings

Recently, I participated in a routine year-end tax planning conference with a client who had a very good income year. In expressing her...

Max Out the Benefits of the QBI Deduction

Since the enactment of the Tax Cuts and Jobs Acts of 2017, I have spent A LOT of time learning about and planning for the Qualified...

Choosing An Accountant

“Why should I choose you?” is a question I hear often from dentists who are contemplating a change. My typical response is that I am not...

Performance-Based Compensation Systems for Owners

When I was a partner in a larger accounting firm, our firm owners met with a consultant to discuss an overhaul of our owner compensation...

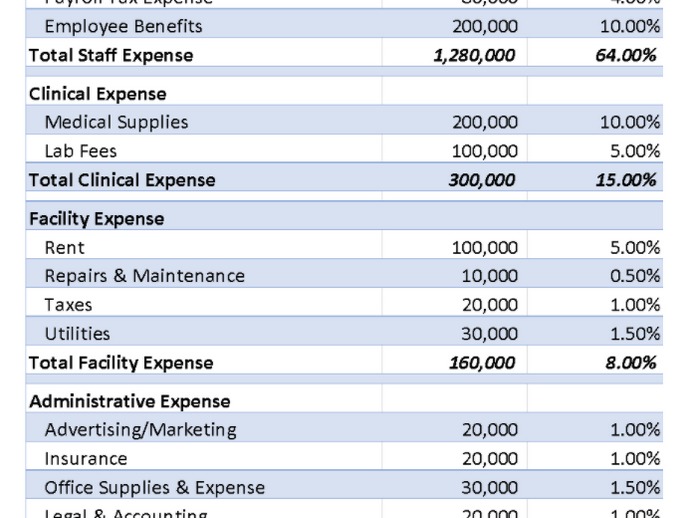

Effective Analysis of Your Practice Financials – Think Big, Then Small

A typical profit and loss statement may contain thirty or more different expenses categories, making it easy to get lost in the minutia...

The Basics of Balance Sheet Analysis

The most well-understood financial statement is the profit and loss statement. Over a stated period of time - typically, a month, a...

Financial Benchmarking

How Does Your Practice Stack Up? A helpful tool to check how you are doing financially is to compare your practice to your peers. The...

Forecasting Financial Performance: Achieve Financial Results by Creating Targets

When it comes to the numbers side of the business, most of my dentist clients have a very low pain threshold. I get it, you have plenty...